Proforma Invoices

Making invoices has never been easier!

What is proforma invoice

A proforma invoice is a preliminary copy of the invoice. It is sent to the buyers of products and services in advance to the delivery of goods or shipments. The pro forma invoice has critical information including details of the purchased items as well as shipping weight and charges. Proforma invoices are majorly used in case of international transactions, primarily imports. Conventionally, Proforma invoices were made manually but today, smart companies rely on online invoice generator software for this purpose. The online invoice generation eliminates the chances of manual error as well as saves important business resources including labor and efforts.

What do I need to include in my proforma invoice?

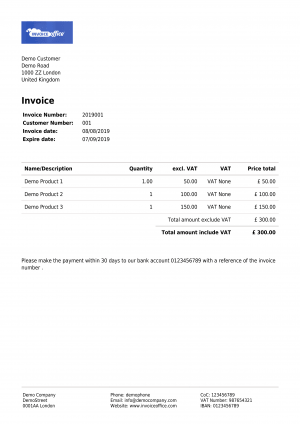

Just like an Invoice, a Proforma invoice has many sections, each one having crucial information. If you are creating a Proforma invoice, make sure it has the following details:

- Invoice date: The date of creating the Proforma invoice.

- Seller details: Complete name and contact information of the seller.

- Buyer details: Complete name and contact information of the buyer.

- Description of the products and services: The product/services sold.

- Subtotal: The subtotal of the amount before deducting taxes and other deductibles.

- Taxes: All taxes that are applicable as per the law of the land.

- Deductions: Any deductions as applicable.

- Total: The net amount to be paid after taxes and deductions.

- Terms and conditions: Any terms and conditions as per the company’s policies.

Difference between invoice and proforma invoice

The primary difference between an Invoice and a Proforma invoice is the time of their issue. While an invoice is issued before a payment is made, a Proforma invoice is issued before the goods or services are delivered. The invoice enables the buyers to know the exact amount of dues with the seller company while Proforma invoices give an idea of what to expect. In terms of format, both invoices and proforma invoices are the same but there is a clear heading “Proforma Invoice”, identifying the former from the latter. Both types of invoices can be generated using Invoice Office a credible online invoice generator.

When should you submit your proforma invoice

Proforma Invoices are always sent before the delivery of the goods and services. These invoices are also known as Good Faith Estimates that help the client have a clear understanding of what to expect from a transaction. This offers a client the ability to arrange for the right amount and also provide their acceptance for the said price. Besides, the seller also gets the assurance that the client is willing to the price for any good or service consignment delivery.

What are proforma invoices used for

Proforma invoice is the best way to streamline the sales processes of your business. It is usually sent to offer the client a clear idea of what to expect. When the client accepts the price, the seller can send the goods and services delivery. Besides this, Proforma Invoices are also used for some additional reasons, including:

• To declare the value of goods to the buyers.

• To get the details required for a commercial invoice from the buyers.

• For internal purchase processes.

How to send proforma invoice online

The online software generator not only allows you to create professional and formatted proforma invoices but also extends options to send them to the clients. You can send an invoice:

- By email: The most convenient and fast way to send an invoice is through email. You can send the invoice as a PDF file using the online invoice generator software.

- By Post: If your customers prefer the conventional way, you can send them a paper copy of the invoice by post.

Through personal delivery: If the need be, you can personally deliver the invoice to the clients and ensure a confirmed delivery.

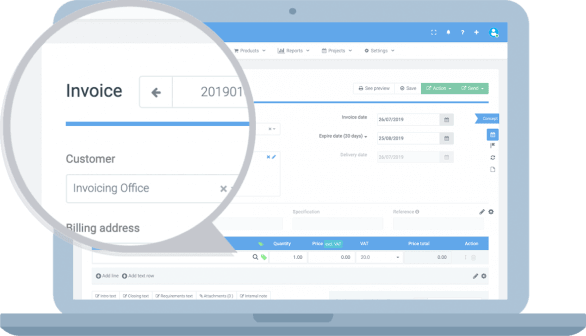

Use Invoice Office to create proforma invoice

The proforma invoice is not an official invoice, so you do not have to pay it or include it in your administration. After you have paid the proforma invoice, the real invoice will follow. You must include this in your accounting and you can use it to deduct VAT. At the top of the proforma invoice, it is clearly stated that it is this type of invoice, because it says “proforma” in the title.

Invoice Office is a free invoice program that makes it easy to create invoices. Also, view our sample invoices to get inspiration for your proforma invoice.

Do you also want to easily create a proforma invoice? Start with Invoice Office for free!

Sophie | Dance Teacher

Invoice program packed with useful functions

- Periodic Invoices

- Payment Reminder

- Own Corporate Identity

- Online Payment Link

- Time Tracking

- Stock Management

- Book Receipts

- Multiple Languages