Multi-currencies Invoicing Setup

Welcome to The Invoice office

With our software, we make the lives of entrepreneurs easier

Multi-Currency Invoicing Setup

If your business serves customers or works with vendors outside your home country, you’ve likely faced the headaches of manual currency conversion, confusing payment processes, and potential errors in your books. It’s time to stop losing revenue and customer trust!

A multi-currency invoicing setup in your application isn’t just a feature—it’s a necessity for global growth and financial accuracy. This setup allows you to bill, collect payments, and manage finances in your clients’ local currencies, simplifying international business significantly.

Invoice Office is with all features available in several languages and is supported internationally. Everything is available in your local language, but you can also send invoices in the language of your preference, it’s up to you!

Why is Multi-Currency Invoicing Critical for Global Businesses?

Supporting multiple currencies is one of the most powerful ways to enhance your international operations and customer experience.

Boost Customer Trust and Conversions: When customers see a price and pay in their local currency (e.g., EUR, GBP, CAD), they know the exact final amount without having to worry about bank conversion fees or fluctuating exchange rates. This transparent pricing reduces cart abandonment and builds instant trust.

Faster, Smoother Payments: By offering invoices in the client’s preferred currency, you simplify their payment process, leading to quicker settlements and improved cash flow.

Minimize Exchange Rate Risk: Fluctuation between the invoice date and payment date can result in losses (Foreign Currency Gains/Losses). Smart multi-currency software can help mitigate this by applying real-time, or locked, exchange rates at the point of invoicing.

Streamlined Accounting & Compliance: Automated conversion and tracking of different currencies simplify month-end closing, financial reporting, and compliance with local tax regulations like VAT or GST.

Key Features for a Seamless Multi-Currency Setup

To truly master international invoicing, your application needs more than just a simple converter. Here are the must-have components of a robust multi-currency setup:

1. Automatic, Real-Time Exchange Rates

Your system must integrate with a reliable financial data source to fetch and apply up-to-date exchange rates. This eliminates the errors and time-consuming work of manual updates.

Tip: Look for the ability to lock the rate on the invoice date for payment transparency, or override the rate if required by a specific contract.

2. Base Currency Control and Reporting

While you invoice in foreign currencies, your internal accounts must be reported in your company’s Base Currency (or functional currency). The system needs to automatically convert all transactions back to your base currency for accurate financial statements and consolidated reports.

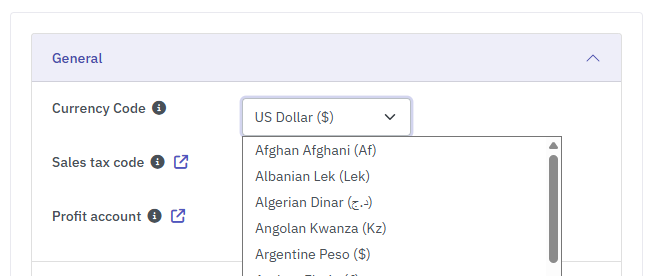

3. Currency-Specific Customer Settings

The best systems allow you to assign a default currency to each customer or vendor. Once set, all future invoices, quotes, and transactions for that contact will automatically use their local currency, maintaining consistency and saving you setup time.