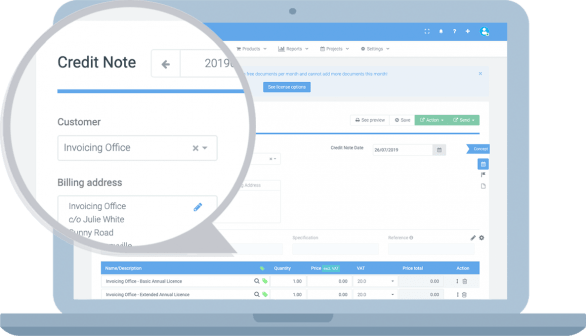

Example credit note

Create credit invoices in minutes.

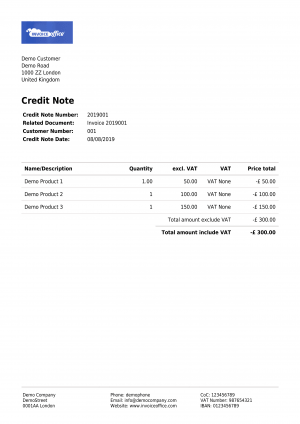

A credit note example of Invoice Office

What is a credit note or credit invoice and what are the requirements? For many entrepreneurs this is sometimes not clear, while it is important for doing business and putting the cash flow in order. Credit notes ensure a correct administration, which in turn is important for your company to grow. Making a clear credit note is professional and ensures clarity for both parties.

Credit notes are a reduction or a remission of the invoice amount of a previously sent invoice. You therefore send a credit note if the customer owes you less than what you initially invoiced. One reason may be that the delivered products are being returned or that the service was cheaper than initially invoiced. A debit note is the opposite of a credit note, so when an amount is higher than previously invoiced. Invoice Office has a credit note example that is perfect for every entrepreneur.

All credit note requirements under each other

With credit invoices you make your administration and VAT correct again. Without this note the invoice will remain open and your accounting is not complete. Below you will find a list to which your bill must comply.

- It is advisable to give a reference to the original invoice to which the credit note relates

- In terms of structure, a credit invoice is the same as an invoice, only the title has been changed and the amounts have been made negative

- The invoice and the credit note together form the composite legal invoice

- You can choose a different numbering than your invoices, or renumber from your regular invoices

- If the invoice contains VAT, the credit note must also contain VAT, only a negative amount

An example credit note for each company

To the right is a sample credit invoice that you can create in Invoice Office.

If you want to see the sample credit note better, click on the link below to download it.

Download the example credit note in PDF

The role of a credit note in invoicing

A Credit Note is a document that allows accountants to record transactions where goods were returned to the supplier, an order was canceled, or there were changes requested in an invoice. Issuing credit notes allow you to make easy adjustments in books and ensure compliance with the rules and regulations governing accounting in your country of work.

Credit notes are of two types primarily:

- Credit notes for outgoing payments.

- Credit notes for incoming payments.

Credit notes, when used efficiently, can be a great tool to maintain accurate and error-free accounting books.

Create a credit invoice or credit note?

Preferably you want to make an invoice or credit note as soon as possible so that you have more time for entrepreneurship. You can choose to use Excel or Word and manually create a credit invoice, but that is usually not the easiest way. With great pleasure, you can now, fortunately, make a credit note free of charge online with the invoicing software from Invoice Office. All you have to do is to create a project and describe what it is about.

Then you create the customer for whom you carry out the project. From that moment you send your credit invoices to your customer by e-mail in a few seconds. This is the perfect way of working for many entrepreneurs, freelancers and small and medium-sized businesses who want to spend as much time as possible on entrepreneurship and as little as possible on administration.

Start today with our software

Our free invoice and administration software for small businesses has many features that are useful for every entrepreneur. Simple billing , hour registration , create quotation , reminders and much more. Get started today!

Sophie | Dance Teacher

Invoice program packed with useful functions

- Periodic Invoices

- Payment Reminder

- Own Corporate Identity

- Online Payment Link

- Time Tracking

- Stock Management

- Book Receipts

- Multiple Languages