Moving VAT means that the VAT is shifted from the supplier to the buyer. This can occur, for example, if an agreement is signed by parties from different countries, and the VAT is paid locally.

It is of course possible to shift VAT with Invoicing Office. I will briefly explain below how you do that.

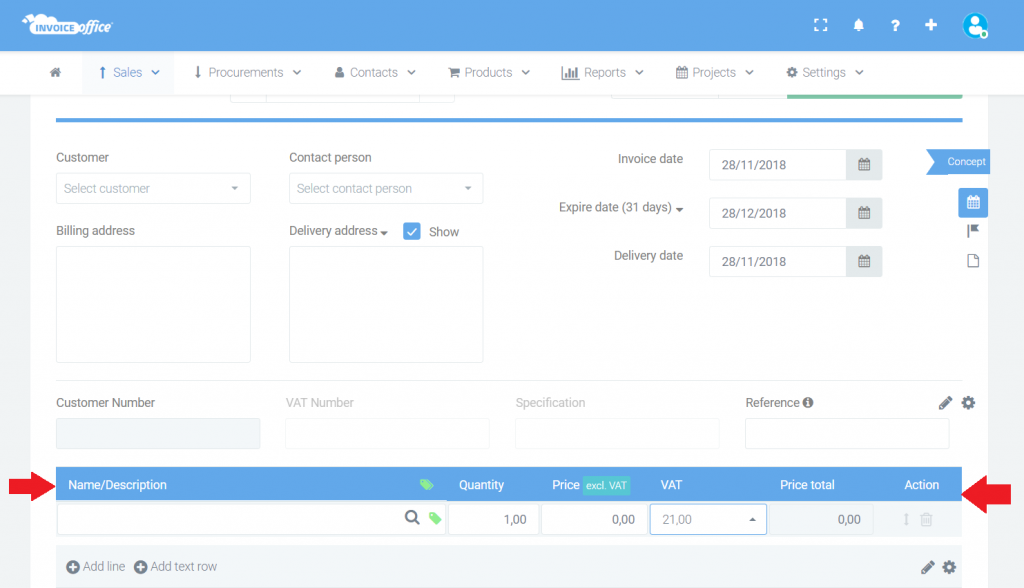

1. In your invoice or quote, go to the horizontal "Product row".

2. Enter the product name, number and price per number. Then click on the arrow next to VAT.

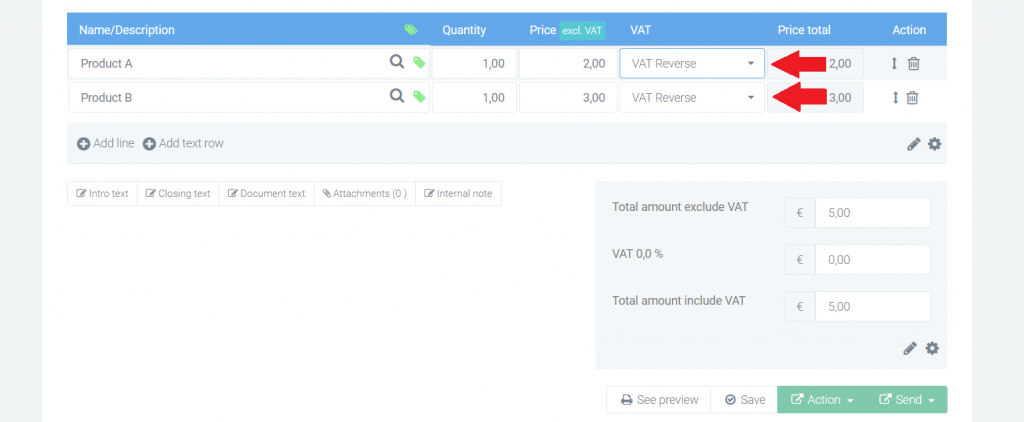

Select "Vat Reverse" and you will see the VAT percentage on the final rail account change immediately to 0% at the bottom right. If you choose to shift VAT, the VAT of the entire document will be shifted. It is therefore not possible to shift the VAT per product row or not.

The VAT will also be automatically transferred to foreign customers.